Why Sourcing From India Shields Your Supply Chain From Today’s Tariff Turbulence

As global supply chains continue to feel the impact of shifting trade policies and rising tariffs, businesses are increasingly reevaluating their sourcing strategies. In particular, U.S.-based importers have been affected by the recent imposition—and temporary pauses—of broad tariff increases under Section 301. While many countries are caught in the middle of ongoing trade disputes, India remains a stable and strategic sourcing partner for companies looking to protect their bottom line and avoid disruptions.

Tariffs on the Rise – But Not Everywhere

The current U.S. administration has reinstated or proposed tariffs on a wide range of imports from countries like China, with rates climbing up to 25% in some cases. Even close allies like Mexico and Canada have faced tariff threats, adding unpredictability to cross-border trade. Although there has been a 90-day pause in reciprocal tariff hikes, the uncertainty surrounding these negotiations creates risk for businesses that depend on affected regions.

India, however, is not included in these recent tariff escalations. Products sourced from India—especially in manufacturing sectors like industrial packaging—continue to enjoy favorable trade terms with the U.S. This makes India a far more cost-effective and secure choice for companies looking to avoid the financial and logistical strain of surprise tariffs.

Stability, Quality, and Long-Term Value

India’s reputation as a reliable manufacturing hub has only grown stronger in recent years. With decades of experience in producing high-quality goods across sectors like textiles, pharmaceuticals, automotive components, and packaging, Indian manufacturers have proven their resilience through global challenges such as COVID-19, inflation, and international trade wars.

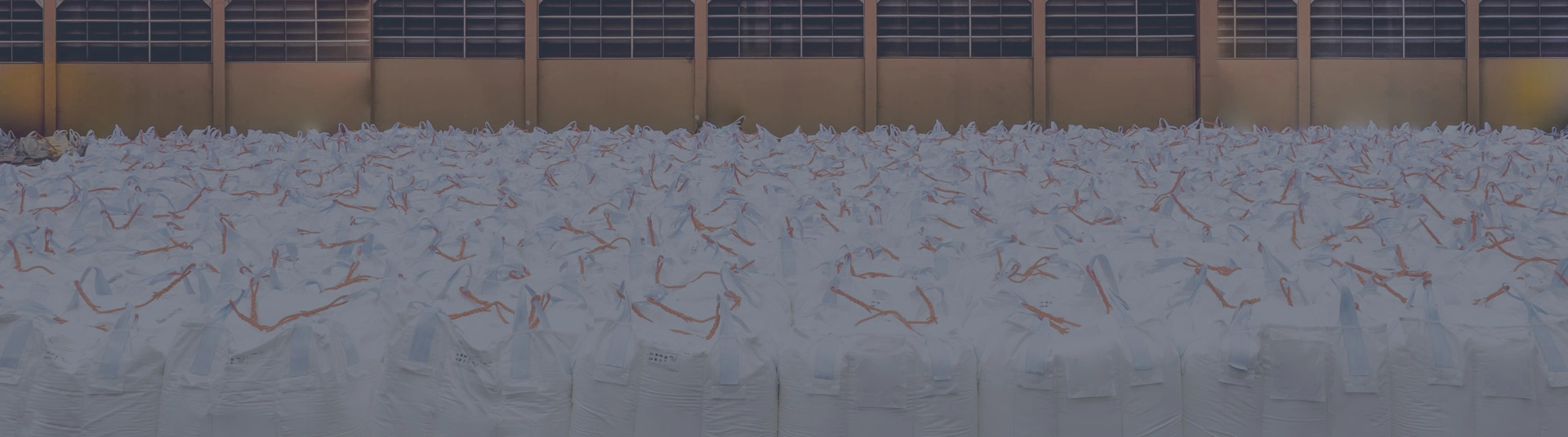

At Palmetto Industries, we’ve invested deeply in Indian manufacturing not only because of the country’s favorable trade position, but also due to the exceptional quality, regulatory compliance, and innovation we’ve consistently found there. From our vertically integrated facilities to our focus on sustainability and zero-waste operations, we’re proud to partner with a country that aligns with our long-term vision.

India: The Bright Spot in a Shifting Landscape

- Fast-Track Talks, Not Tit-for-Tat Tariffs – Washington and New Delhi are choosing dialogue over escalation, finalizing agreements designed to avoid the looming tariff hike.

- A Growing Strategic Partnership – A fresh roadmap toward a broader trade pact aims to lock in tariff certainty for years to come.

- Diversification, Stability, and Scale – India’s democratic institutions, English-speaking workforce, and massive infrastructure push make it one of the few low-cost manufacturing hubs where policy risk is falling instead of rising.

What This Means for Your Bottom Line

| Question | China-Heavy Supply Chain | India-Based Supply Chain |

|---|---|---|

| Tariff exposure (2025) | Up to 145% and uncertainty | Negotiated 0–10% with 90‑day pause; odds favor reduction |

| Retaliation risk | 125% counter‑tariffs cut U.S. export options | Cooperative talks; no retaliation on U.S. goods |

| Lead‑time reliability | Port congestion & compliance checks | Expanding port capacity, digital customs clearance |

| Regulatory visibility | Week‑to‑week policy shifts | Clear roadmap toward bilateral accord |

Palmetto Industries: Built-In Peace-of-Mind

- Vertically integrated Indian facilities give us end-to-end control and ISO/BRC food‑grade certifications.

- Zero-waste manufacturing and high recycled‑content options keep sustainability intact even as trade winds shift.

- On‑the‑ground policy monitoring means we react to tariff headlines before they reach your invoice.

- S. inventory buffers hedge any unforeseen customs delays, so you receive product exactly when promised.

The Takeaway

Tariffs are no longer background noise—they are a core supply‑chain cost driver. By pivoting to India (or doubling down on your existing India‑centric strategy), you insulate your business from the steepest duties, escalation risk, and headline volatility affecting other sourcing hubs. Palmetto’s decades‑long presence and fully integrated operations in India make that transition seamless.

Ready to future‑proof your packaging costs? Let’s talk about how an India‑first sourcing model can keep your bulk‑bag program on budget and on schedule—no matter what Washington does next.